Commercial and office space not facing glut despite slow take-up

COMMERCIAL and office space in the country is not facing a glut, although there is some slowdown in the take-up rate over the past few years.

Malaysian Institute of Estate Agents immediate past president Siva Shanker said traditionally, the occupancy rate has always been on the high 80s but has now come down to the low 80s.

“Therefore, there are a few notches in disparity within the commercial space. With the oil and gas figures shrinking, people are giving up spaces.

“There is also a slowing down in take-up rates. It is not a huge problem. I think the overhang will sort of ‘take care of itself’ within the next few years,” he said at Business Times’ pre-budget roundtable discussions, here, on Monday.

He said people have to take a pragmatic view about the current situation. “When a brand new building is completed, you can’t expect it to be occupied from Day One overnight. It takes a year to fill and you’ve got to give the market that leeway.

Again, I really would not call it a glut. This is like a big cycle, and it will correct itself in a short while and I think occupancy rate will shoot up to the high 80s,” he said.

Henry Butcher Malaysia chief operating office Tang Chee Meng said commercial and office space was in the doldrums when the country faced a financial crisis a few years back.

“At that time, lot of developers converted their commercial land into other uses. For long time, the market was deprived of the supply of office space. “But after the recovery, a lot of developers began to look into building office buildings. So the supply is certainly short.”

Further, the coming few years will continue to be a tenants’ market with more quality office space available. Owners and investors may experience stiff competition in retaining existing tenants or leasing out new space.

According to a survey by Knight Frank Malaysia entitled “Malaysia Commercial Real Estate Investment Sentiment Survey 2016”, fund and real estate investment trust managers are expected to be actively investing this year, seeking opportunities in a slow property market.

Fifty-three per cent of the respondents surveyed indicated their intention to invest in the office segment.

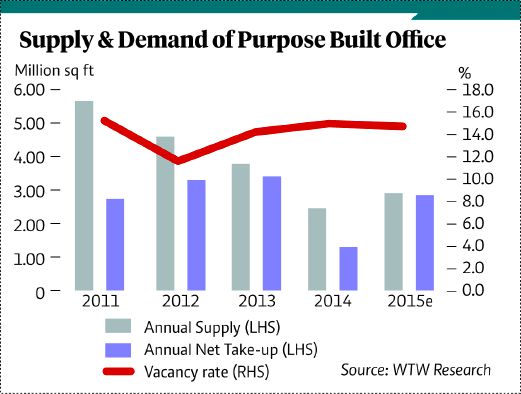

CH Williams, Talhar & Wong (WTW) Property Report 2016 said occupancy rates may drop further this year as a slower take-up is expected for new supply of office space as the uncertain economic climate may restrain multinational corporations and small and medium enterprises from expansion.

Yields for prime office space are maintained between six and 6.5 per cent, said the report.

“One concern is that we have a lot of office space in buildings like the Tun Razak Exchange and Wawasan (Merdeka PNB 118) being carried out by government-related organisations,” said Tang.

“We have more space coming up that will really add on to the existing situation — not glut — but a situation where it is taking a longer time to fill up the buildings.”

Eco World Development Group Bhd president and chief executive officer Datuk Chang Khim Wah said as a developer, he would look at it differently.

“We must dissect the market and see where it is possible, especially commercial space. As an individual developer, we always need to look at a project at the ground feasibility. For example, the commercial space that we are doing with UDA Holdings Bhd, which is the Bukit Bintang City Centre. There are always macro numbers that we are crunching.

“It already has access to the light rail transit. We know that our catchment is going as far as Kajang, with the mass rapid transit going through that site. It is a 19ha prime and beautiful flat land next to the Golden Triangle. We have the opportunity to do a very contemporary modern integrated commercial development,” he added.